Act on climate today. Lead tomorrow.

Carbometrix guides private-market professionals and their portfolio companies in effective decarbonization. We combine climate advisory services with an intuitive platform.

Contact us Financial institutions trust us as their strategic partner to deliver on their net zero goals worldwide

€1,100B+

AUM covered

120+

financial

institutions

800+

companies

Experts supporting you.

Intuitive platform.

Lasting impact.

For Financial Institutions

Drive value, anticipate risk and future-proof your investment decisions by computing and acting on your emissions inventory

Learn more For Businesses

Turn decarbonization and sustainability into a strategic advantage to propel your business and build trust with your investors, your lenders and clients

Learn more Climate change is impacting your business. Let’s address it together.

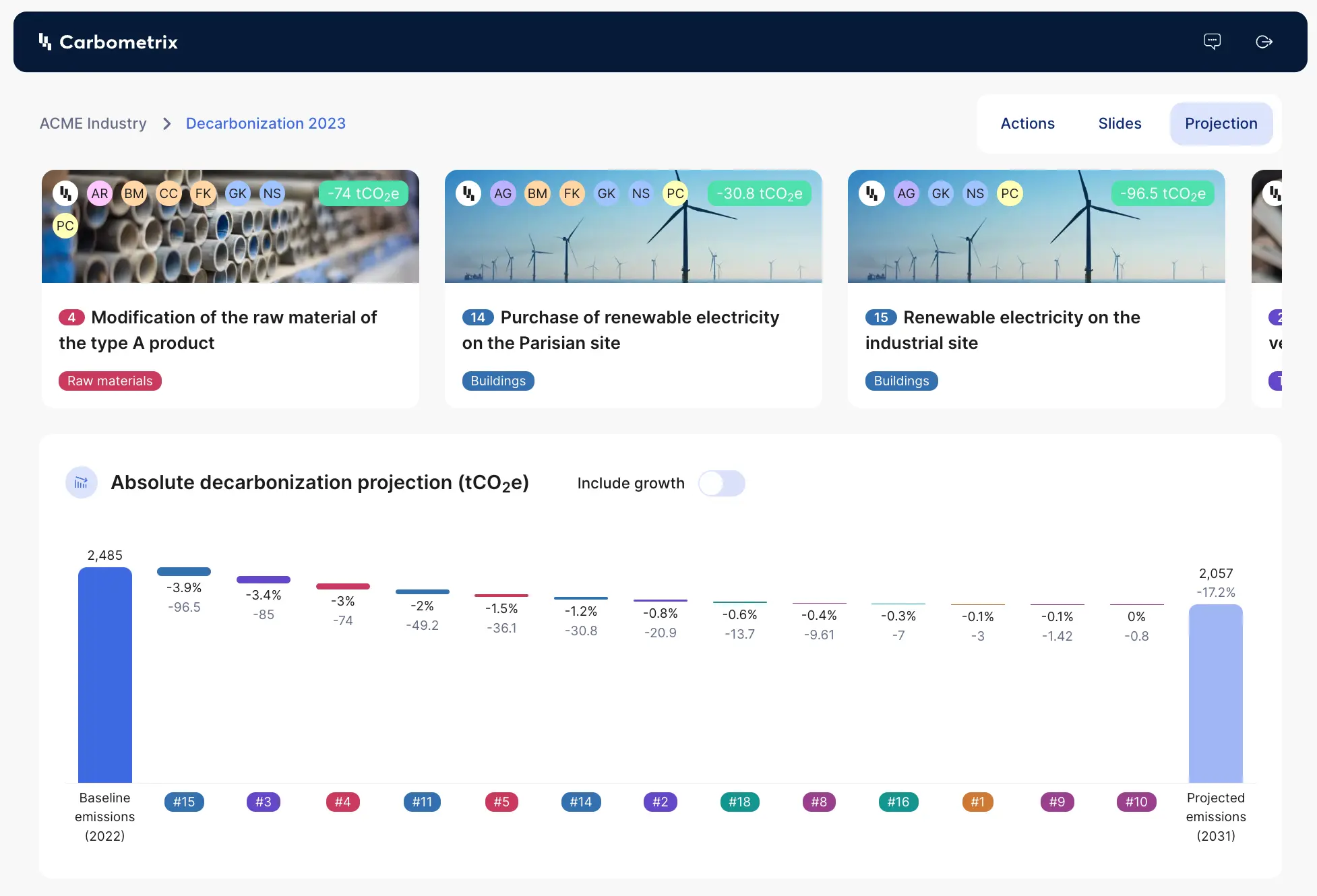

Measure and decarbonize

- Collect and analyze data relevant to your operations and industry across scope 1, 2, and 3

- Build a strong foundation, define a decarbonization trajectory and monitor progress against goals

- Build a comprehensive and actionable decarbonization plan, including costs & savings, timelines, resources and governance

Report and comply

- Stay ahead of regulatory demands and align with SFDR, CSRD, TCFD, SEC, SECR

- Produce audit-ready reporting to meet stakeholder expectations

- Share progress with confidence with clear dashboards and robust methodologies

Create and protect value

- Assess physical and transition climate-related risks

- Identify low-carbon growth opportunities

- Develop a structured transition roadmap to achieve carbon reduction goals and mitigate climate risks

Get expert support at each step of your investment cycle

Fund raising

Due Diligence

Monitoring

Exit

Reporting

Climate Strategy

Financed Emissions

Full Carbon Footprint

Avoided Emissions

Target setting

and monitoring

Decarbonization Plan

Climate Risks

Why choose Carbometrix?

Business & climate expertise

Our climate consultants are sectoral experts who know how to deal with multiple stakeholders to drive long-term business value for investors and portfolio companies.

We meet you where you are

We meet you where you are, offering services from carbon footprinting to custom decarbonization strategies that align with your goals.

Hybrid model

Our approach blends expert consulting with an intuitive platform to deliver high-quality solutions tailored to your needs.

What standards should you use?

Carbometrix’s engineers are certified in both GHG Protocol and Bilan Carbone® methodologies, leveraging internationally recognized standards and frameworks. Our team crafts ambitious, sector-specific climate strategies designed to meet the unique needs of Financial Institutions, ensuring alignment with best practices and global benchmarks.

Should you commit to SBTi or not?

Carbometrix’s engineers and finance experts guide you in selecting the most suitable framework for your goals, navigating options to match your organization’s priorities and compliance needs. With their expertise, you can confidently choose an approach that enhances both impact and credibility.

How to keep up with regulations?

From Europe’s CSRD (Corporate Sustainability Reporting Directive) to the SEC’s enhanced climate-related disclosures, keeping up with the global regulatory landscape can be challenging.

Navigate climate compliance with confidence using our expert advisory and advanced carbon platform. From strategy to reporting, we are by your side to ensure your compliance efforts are strong, accurate, and impactful.